how to set up a payment plan for california state taxes

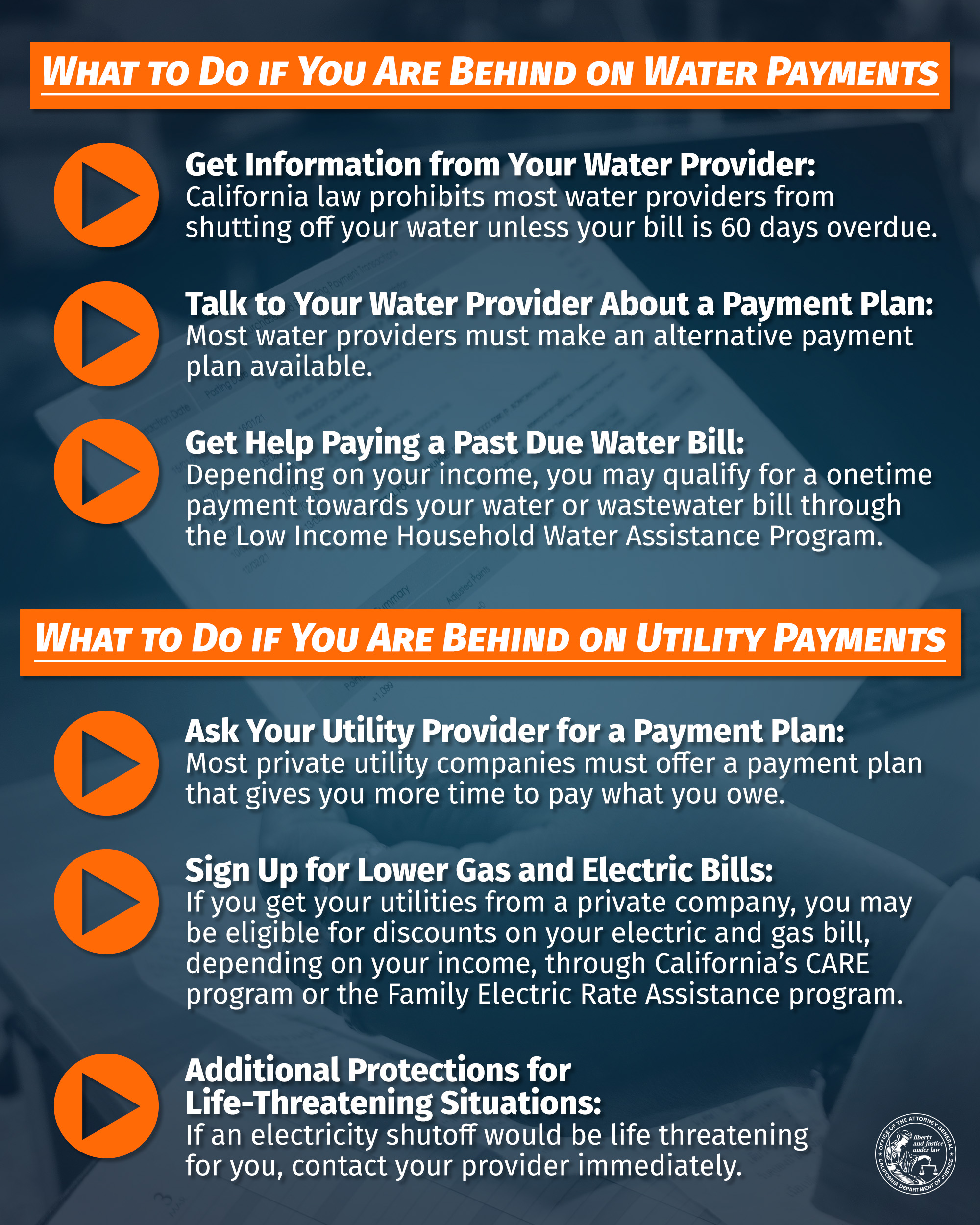

How do i set up a payment plan for california state taxes owed. Please review these requirements carefully before you make your request.

California Tax Payment Plan Get California Tax Help Today

Your payment options depend on your total tax liability.

. Pay a 34 set-up fee that the FTB adds to the balance due Make monthly payments until the taxpayer pays the entire tax bill in full Pay by automatic withdrawal from a bank account Make. Individual taxpayers need to pay a 34 setup fee that is added to their balance when setting up a payment plan. How do i set up a.

Connecticut State Department of Revenue Services. You can also review and manage your payment plan online. You must meet certain basic admission requirements to be approved.

Call our Collections Department at 8043678045 during regular business hours to speak with a representative. Individuals can complete Form 9465 Installment Agreement. Most states offer some kind of installment payment plan as well although the procedure varies from state to state.

Once this is done you will make. Meanwhile businesses are required to pay off whats owed for the. A 45 fee is charged for Individual Income Tax Payment Plan Agreements.

Yes California offers taxpayers the option to set up a California tax payment plan. The easiest way to obtain the info you. How do I apply for a payment plan Installment Agreement.

If you are ineligible for a payment plan through the Online Payment Agreement tool you may still be able to pay in installments. To request that an. The California FTB and the IRS are separate government agencies and have their own rules for payment plans.

You can have both a payment plan with California and the IRS at the same. To do so you will need to file Form 9465 Installment Agreement Request and Form 433-F Collection Information Statement. State Payment Plans.

IMPORTANT INFORMATION - the following tax types are now available in myconneCT. If you are looking to set up a payment plan that is less than 12 months in length and you owe less than 50000 you have a few options. Department of Revenue Services.

48 months or less.

Ca Inflation Relief Money Debit Card Payment Schedule The Sacramento Bee

Will You Get A Payment California Readying Tax Refunds For 23 Million Residents Orange County Register

Golden State Stimulus Update More Payments New Timeline Abc10 Com

Estimated Income Tax Payments For 2022 And 2023 Pay Online

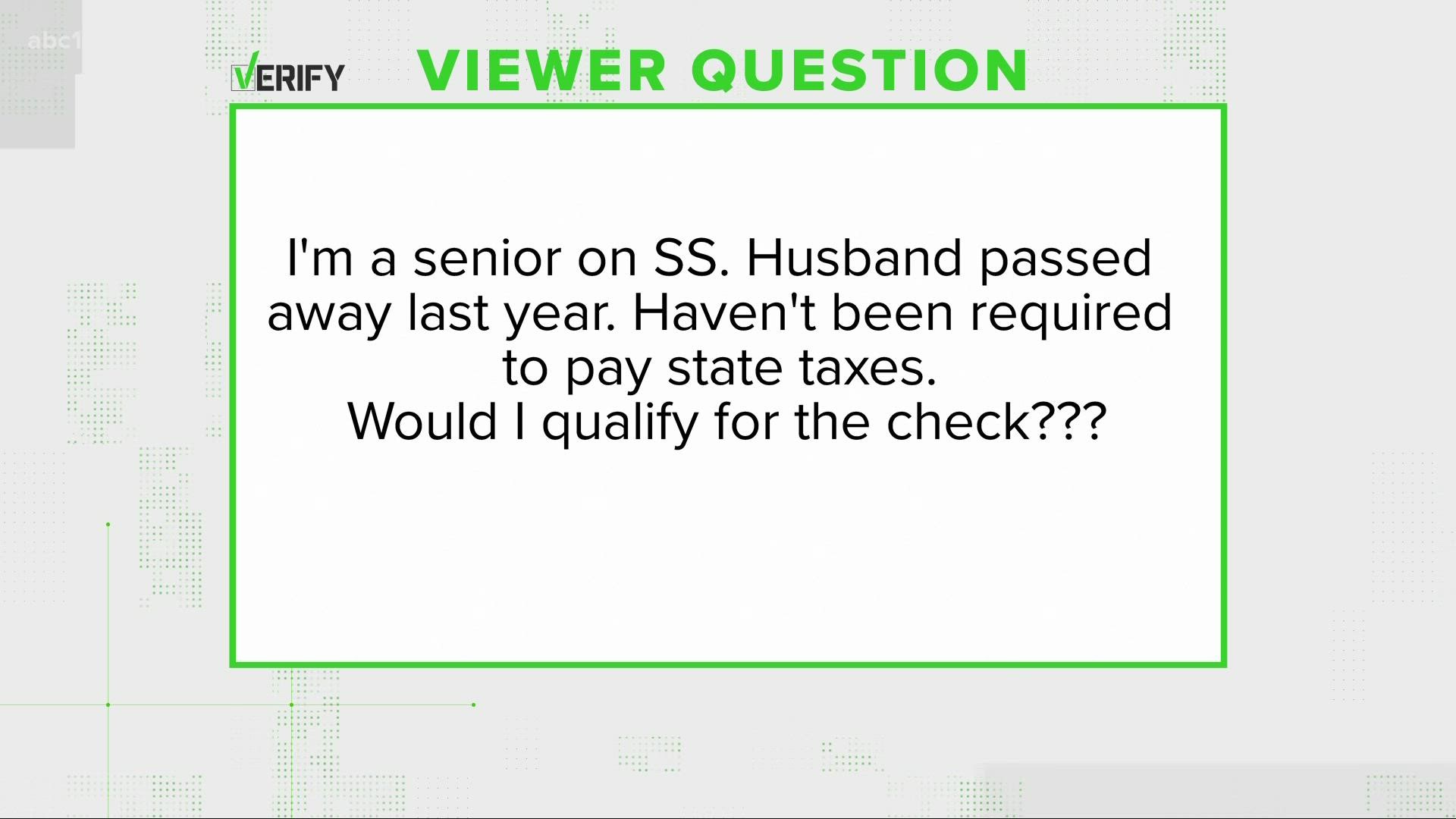

California Inflation Relief Check Do I Qualify According To My Filing Status As Usa

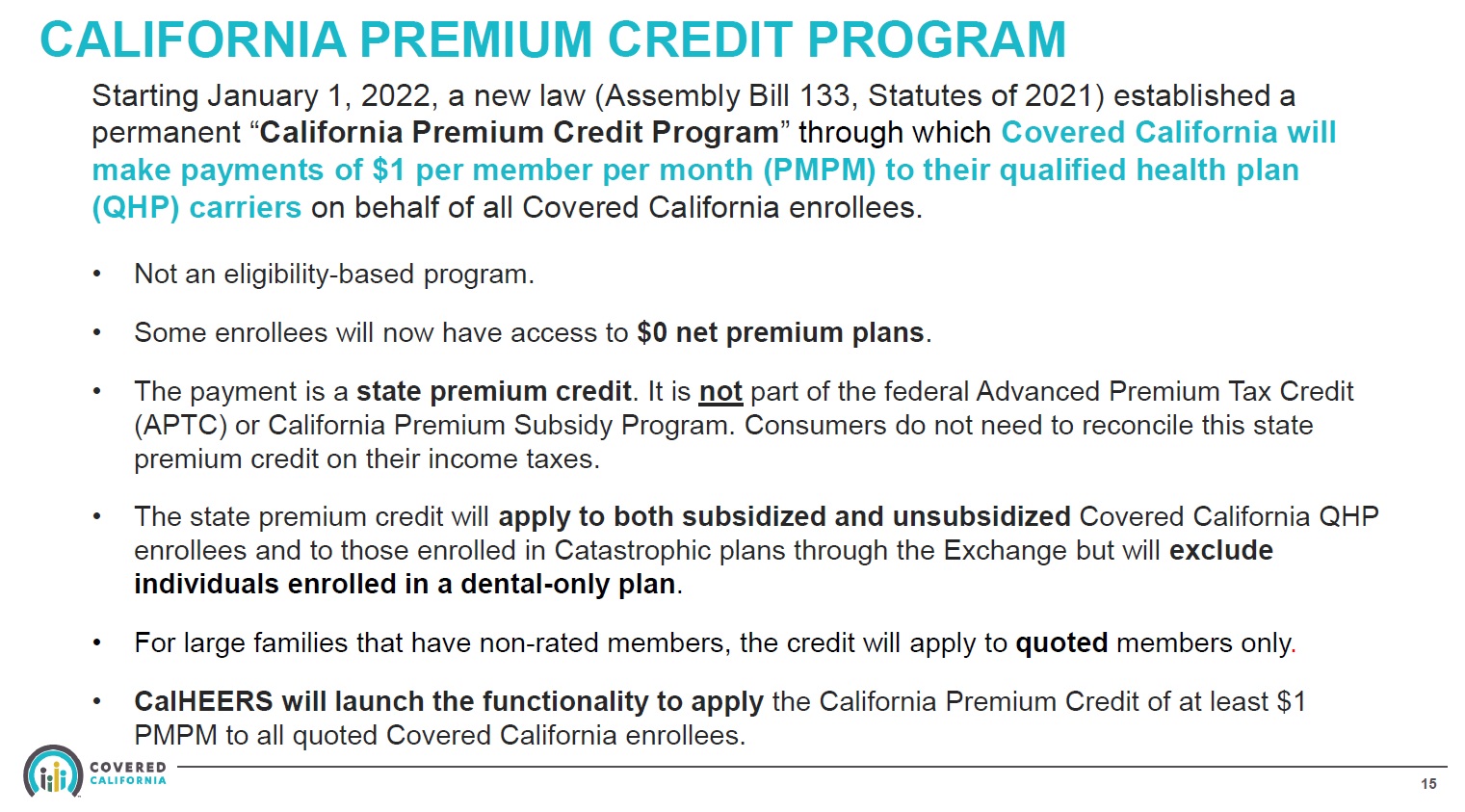

1 Dollar Covered California Member Bonus For 2022

Christopher Keleshyan Mba Posted On Linkedin

Ac Payments California Who Will Receive These 225 Checks Marca

State Accepts Payment Plan In Santa Maria Ca 20 20 Tax Resolution

Gop S Faulconer Pitches Income Tax Cut Plan For California

How To Set Up A Payment Plan With The Irs In California

Solved Where Are The Federal Filing Estimates Instructions In 2020 Lacerte It Used To Automatically Populate And Now It Is Completely Gone We Are Having To Create Our Own Instructions Letter To

New California Alaska Airlines Mileage Plan Members Get A Free Flight Up To 25 000 Loyaltylobby

California Estimated Taxes In 2022 What You Need To Know

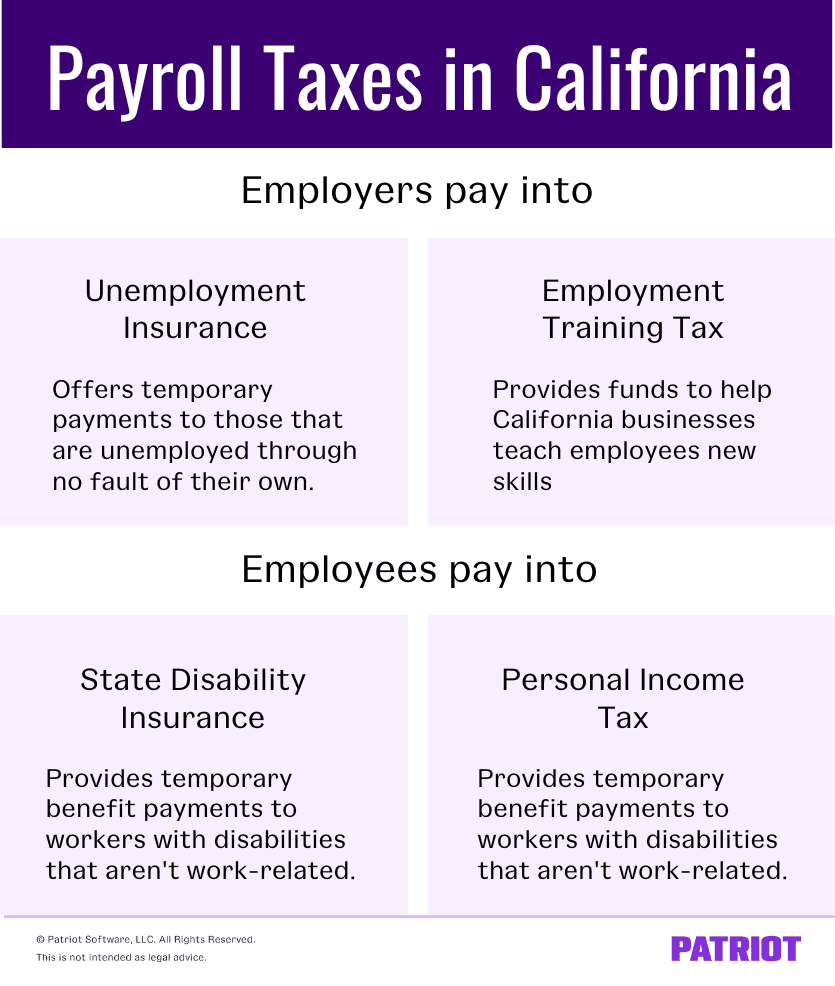

Understanding California Payroll Tax

California Payment Plan Application Help

Politifact 50 Cent S Upset With Biden S Tax Plan What Does It Mean For The Rest Of Us